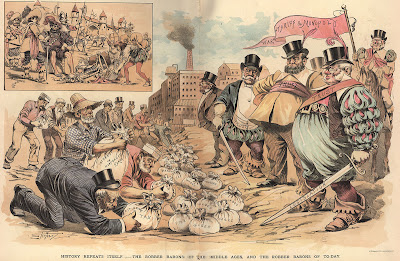

As part of its mission to drive sane people mad, the New York Times has published an epic article on The New Tycoons by Louis Uchitelle. The gist of it is that today's tycoons see themselves as benevolent demiurges, and are earnestly patting themselves on the back for their (tax-deductible) philanthropy, while ignoring the fact that a good number of the wounds they propose to heal were administered with their own brass knuckles.

Sanford I. Weill of Citigroup, for instance, compares himself favorably to Andrew Carnegie. It'd be easy enough to sneer at Carnegie's ethereal highmindedness by pointing out the extent to which it relied on allowing thugs like Henry Clay Frick to handle the grubby work of murdering the poor. But perhaps it'd be more fruitful to consider Carnegie's thinking at its best; in an age when Paul Krugman is seen as a socialist firebrand, Carnegie sounds almost like Emma Goldman. It's a bit of a stretch to imagine that he has an ideological heir among today's billionaires, but this is just what Uchitelle invites us to do:

These days, Mr. Weill and many of the nation’s very wealthy chief executives, entrepreneurs and financiers echo an earlier era — the Gilded Age before World War I — when powerful enterprises, dominated by men who grew immensely rich, ushered in the industrialization of the United States. The new titans often see themselves as pillars of a similarly prosperous and expansive age, one in which their successes and their philanthropy have made government less important than it once was.By whose standards was that era prosperous? And who gets to decide how "important" government is to education, and the relief of the poor, and the allocation of natural resources, and the protection of public health?

I'll give you three guesses.

If you don't know what became of these genial men and their vast fortunes, and the pyromaniac blaze of their Gilded Age, you certainly won't learn it from Mr. Uchitelle, who tiptoes around the subsequent decades with the exaggerated discretion of a tipsy butler.

Those earlier barons disappeared by the 1920s and, constrained by the Depression and by the greater government oversight and high income tax rates that followed, no one really took their place. Then, starting in the late 1970s, as the constraints receded, new tycoons gradually emerged, and now their concentrated wealth has made the early years of the 21st century truly another Gilded Age.I could accept this paragraph if it ended with a call to fetch the pitchforks, the torches, the tar and the feathers. But Uchitelle, who has perhaps been made dizzy by the high-octane miasma of Atlas Shrugged, seems to find the idea pretty agreeable.

“The whole world is moving to the American model of free enterprise and capital markets,” Mr. Weill said, arguing that Wall Street cannot be a big player in China or India without giants like Citigroup. “Not having American financial institutions that really are at the fulcrum of how these countries are converting to a free-enterprise system,” he said, “would really be a shame.”Uchilette does find naysayers, of course, and quotes them; balance requires it. But overall, the terms of debate remain simplistic: Are tycoons world-healing demigods? Or are they merely necessary to our "expansive" nation, like air and water and lebensraum?

The condition of working life in the former Gilded Age is no more adequately discussed in this article than Carnegie's anti-imperialism. Nor does it address the harmful effect of a political climate favorable to tycoons on the public's access to information and education (except by serving as an example of it). Apropos of which, here's Henry Adams, writing back in the 1880s:

[T]he amusing thing is that no one talks about real interests. By common consent they agree to let these alone. We are afraid to discuss them. Instead of this the press is engaged in a most amusing dispute whether Mr. Cleveland had an illegitimate child and did or did not live with more than one mistress.Thank heavens for Progress!

Anyway, the important thing to remember about the Gilded Age is that the tycoons built our national infrastructure and made America rich and powerful; the fact that they did so with the help of protectionism, government subsidies, and general cronyism is beside the point, as is the fact that we're now selling off our infrastructure to foreign investors in order to finance our own Gilded Age. Radical critique, in this context, doesn't go much beyond the notion that today's millionaires might, after all, be just as happy with $10 million per year as $200 million (an ethical stance expressed perfectly by Chester A. Lampwick: "I'm not greedy. As long as I've got my health, and my millions of dollars, and my solid gold house, and my rocket car, I don't need anything else").

Mr. Weill, we learn, enjoys giving his money away. He doesn't much like the idea of having his money "taken" from him, though; as Uchilette helpfully explains, "the new tycoons oppose raising taxes on their fortunes."

Of course they do. That tycoons are universally competent geniuses is demonstrated by their net worth; who could possibly be more qualified to identify suffering and relieve it? Why should government be allowed to extort money from them? Sure, they get a lot of it back, in the form of subsidies, no-bid contracts, favorable legislation, and infrastructure investments. But if Ayn Rand taught us anything, it's that you can't have freedom where there is coercion, any more than you can mine coal without machine guns.

“The income distribution has to stand,” Mr. Griffin said, adding that by trying to alter it with a more progressive income tax, “you end up in problematic circumstances. In the current world, there will be people who will move from one tax area to another. I am proud to be an American. But if the tax became too high, as a matter of principle I would not be working this hard.”UPDATE: Misattribution of quote fixed, thanks to Tom.

4 comments:

Hey, wait a sec. Warren Buffet is in favour of raising taxes on the ultra-rich like himself. He's a vocal critic of Bush's tax cuts on the wealthy.

I personally have mixed feelings about the Bill and Melinda Gates Foundation being anything but PR and self-serving tax dodge, but it seems about as close a thing among the modern tycoons to Carnegie's funding of public libraries all across the US as you might find.

http://www.responsiblewealth.org/

Here ya go, Phila. This was set up to combat the elimination of the estate tax by Bill Gates, Sr (the father of the Microsoft weenie) and Buffet and a few other ultra-rich guys.

::: "We can have a democratic society or we can have great concentrated wealth in the hands of a few. We cannot have both."

– Louis Brandeis

Supreme Court Justice

(1916-39):::

Tom,

You're right...that was a typo. I've fixed it. Thanks!

I personally have mixed feelings about the Bill and Melinda Gates Foundation being anything but PR and self-serving tax dodge, but it seems about as close a thing among the modern tycoons to Carnegie's funding of public libraries all across the US as you might find.

My feelings about it are pretty negative. I'm sure they do some good, but they could do far more by changing Microsoft's methods of doing business (never mind the Foundation's investment priorities).

From what I know of Carnegie, he had sincere ideals, and those ideals are almost completely beyond the pale these days, politically speaking. So the comparison seems completely out of line to me, in historical terms...except to the extent that it's about rich people giving away money to address what they see (or depend on) as problems. Given that economics is supposed to be the philosophical center of our lives, it's a little frustrating to see how little time the "experts" spend explaining the larger context of economic decisions.

But then, this is one of those topics on which I'm a bit of an extremist.

Post a Comment